Malta has established itself as a prime fintech hub for over a decade by hosting and attracting a variety of financial services businesses and structures including Alternative Investment Funds (AIFs), Professional Investor Funds (PIFs), UCITS schemes, electronic money institutions and payment service providers, as well as having developed into the world’s largest iGaming hub.

Malta has sought to create a regulated framework for innovative technology that is built upon three pillars: consumer protection, market integrity and financial stability. In the framework of developing a broad national legislative strategy supporting Distributed Ledger Technology (“DLT”) assets and embracing the blockchain innovation, the Government of Malta has also been supporting the relative development in the financial investment services sector relative to the investment funds (‘’Funds”), in particularly PIFs.

Malta has established itself as a prime fintech hub for over a decade by hosting and attracting a variety of financial services businesses and structures including Alternative Investment Funds (AIFs), Professional Investor Funds (PIFs), UCITS schemes, electronic money institutions and payment service providers, as well as having developed into the world’s largest iGaming hub.

Malta has sought to create a regulated framework for innovative technology that is built upon three pillars: consumer protection, market integrity and financial stability. In the framework of developing a broad national legislative strategy supporting Distributed Ledger Technology (“DLT”) assets and embracing the blockchain innovation, the Government of Malta has also been supporting the relative development in the financial investment services sector relative to the investment funds (‘’Funds”), in particularly PIFs.

Country Highlights

| GDP GROWTH: 6.6% in 2017 |

TIMEZONE: Central European Time Zone

(UTC+01:00) |

| MALTA FUNDS: 580+ Investment Funds with combined NAV of €9.7 billion |

MALTA FINANCIAL SERVICES

AUTHORITY: Approachable, Single Regulator |

FUND DOMICILE RECOGNITION: Rated No. 1 Europe’s Favoured Fund

Domicile (Hedge Fund Review’s 2013 and 2014 Service Provider Rankings) |

TOTAL ASSET VALUE PIFS: €6.6 billion |

| SECTOR EXPANSION: 25% Annual Growth |

FINANCIAL SERVICES FRAMEWORK: EU and OECD approved |

Legal Basis

Malta PIFs are regulated but yet flexible investment vehicles for those promoters who wish to establish Collective Investment Schemes (CISs) but which fall short from being classified as AIFs under the AIF Directive 2014/65/EU. The current Malta fund regulatory framework permits the setting up of Virtual Currency (VC) funds as PIFs. For this reason, several amendments to MFSA’s Investment Services Rules for Qualifying Professional Investor Funds (“Rules”) were carried out by the Malta Financial Services Authority (MFSA) in order extend the possibility for PIFs to invest in VC.

The Investment Services Act (“ISA”) establishes the principal regulatory framework governing investment services and funds. As a general rule, any fund operating in or from Malta is required to obtain an appropriate licence from Malta Financial Services Authority (MFSA).

A PIF licence is issued by the MFSA once the PIF fully satisfies the requirements and criteria relating to its nature and purpose. PIFs investing in VC will need to submit additional application documents in line with the Rules

Benefits

- Legal Form Variants

- Self Managed Fund Option

- PIF New Benefit: Virtual Currency Investments in a Regulated Framework

- Freedom to use Foreign Administrators

- No Investment / Borrowing Restrictions

- Rules and Documentation in English

Eligibility

- In- house Investment Committee

- External Valuer

- Fit & Proper Test

- Approved Service Providers

- Appropriate Legal Vehicle

- Min. Investment: €100,000

- MFSA Approved Offering Documents

- Local Director, Compliance & MLRO

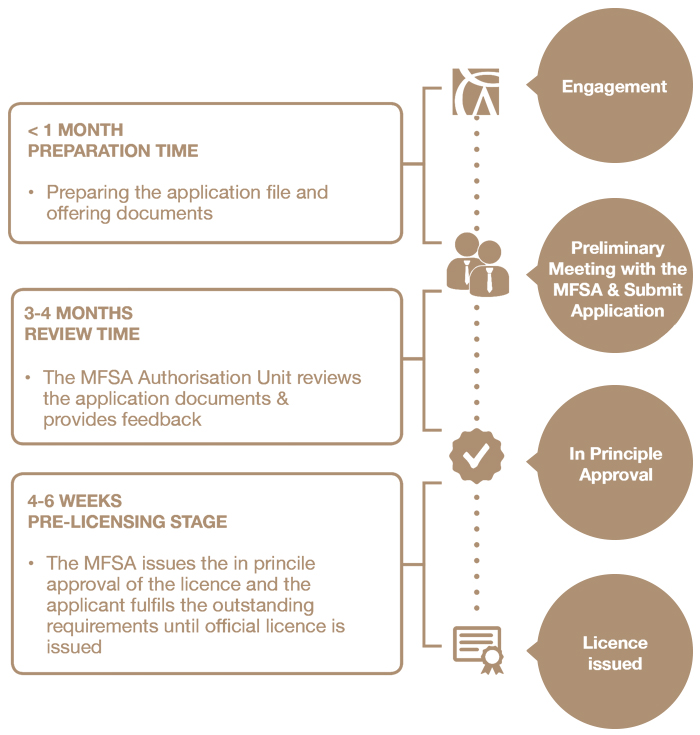

Process & Timeline

Why Work With Us