Malta enjoys a stable political climate and a bi-partisan political scene that is largely convergent on issues of national and economic importance. The country is considered to be one of the best performing Eurozone economies, with a steady economic growth and a low unemployment rate.

A Malta Royalty Company may own or have assigned to it royalties from qualifying patents or copyrights which are entitled to a full exemption from income tax in Malta. Nonresident shareholders are also exempt from tax on royalties subject to certain conditions being fulfilled.

Malta enjoys a stable political climate and a bi-partisan political scene that is largely convergent on issues of national and economic importance. The country is considered to be one of the best performing Eurozone economies, with a steady economic growth and a low unemployment rate.

A Malta Royalty Company may own or have assigned to it royalties from qualifying patents or copyrights which are entitled to a full exemption from income tax in Malta. Nonresident shareholders are also exempt from tax on royalties subject to certain conditions being fulfilled.

Country Highlights

| DOUBLE TAX TREATY: Extensive double tax treaty network |

TAX SYSTEM: EU Approved |

| TAX DEDUCTIONS: Tax deductions of royalty payments |

CURRENCY:Euro € |

| WITHHOLDING TAX: No WHT tax on royalty payments for rights outside Malta |

TIME ZONE:Central EUropean Time Zone (UTC+01:00)

|

| FOREIGN COMPANY: No Controlled Foreign Company legislation |

|

Legal Basis

Malta Royalty Companies are incorporated in terms of the Maltese Companies Act, which is Malta’s principal corporate legislation. The Act is predominantly based on common law principles, and is also in line with EU Directives.

Malta Royalty Companies are onshore entities setup as partnerships or limited liability companies - the latter being the most popular type of corporate entity, due to its flexibility and tax efficiency.

Benefits

- Incorporation of the company is on the same day;

- Tax for royatly payments are deducted;

- When dealing with capital any currrency may be used;

- Establishment and operating costs are relitively low;

- On certain royalty payment one is tax exempted;

Eligibility

- Initial share captial is a minimum of € 250;

- The appointment of 1 Malta director & company secretary;

- Minimum of one share holder;

- Aquirement of Company formation documents;

- The appointment of an auditor;

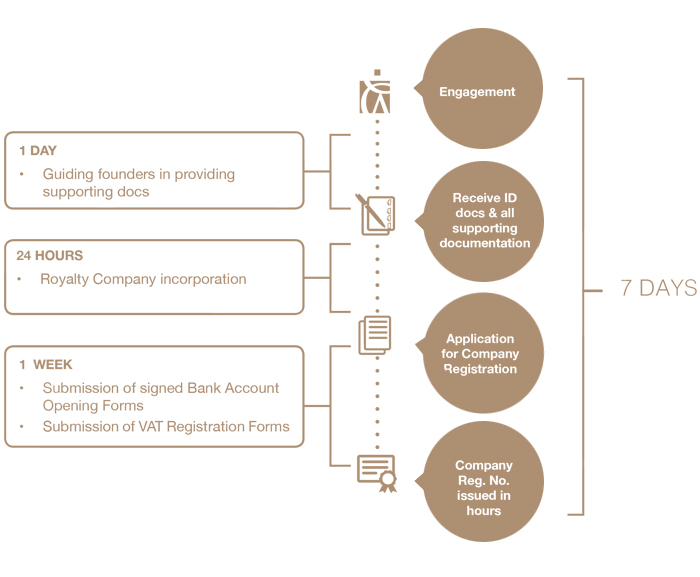

Process & Timeline

Why Work With Us